Medical Benefits

Welcome

Our employees are our most valuable asset.

Len-Tex Corp cares about the health, wellbeing and financial security of our associates and is proud to offer a comprehensive benefits program to all eligible employees. Your benefits are an important part of your total compensation; therefore, we invite you to familiarize yourself with the details of these plans.

Who is Eligible and When?

All regular full-time employees working 30+ hours a week are eligible to enroll in health insurance. You may enroll when initially eligible as a new hire, or each year during open enrollment. You will be notified of the open enrollment dates annually. The benefits you choose during open enrollment will become effective on June 1, 2025.

How Do I Enroll?

To enroll or make changes to your benefits, log into isolved & complete the Benefits Enrollment electronically. Instructions on how to do so will be provided to you from Human Resourses.

Qualified Life Events

Unless you experience a life-changing qualifying event, you cannot make changes to your benefits until the next open enrollment period. Qualifying events include things like:

- Marriage, divorce or legal separation

- Birth or adoption of a child

- Change in child’s dependent status

- Death of a spouse, child or other qualified dependent

- Change in residence that impacts the service area

- Change in employment status or a change in coverage under another employer-sponsored plan

Health Plan Overview

Len-Tex offers three medical plans through Harvard Pilgrim Health Care. Len-Tex’s employer paid Health Reimbursement Account (HRA) will apply to employees who enroll in the POS or Copay plan, but NOT the Best Buy HMO HSA Plan.

When you have a choice of medical plans, there are three things you should consider:

- The provider NETWORK and requirement for REFERRALS between providers

- The cost of USING the insurance when you need medical services or prescription drug.

- The cost of OWNING the insurance, meaning your per paycheck deduction

The POS & Copay plans provide access to providers all over the country, allow you to see Out-Of-Network (OON) providers (you’ll pay more for those services though) and do not require you to get referrals.

The HMO/HSA plan includes In-Network (IN) providers based in New England only and requires referrals.

Common health insurance terms:

- Deductible: This this the amount Harvard Pilgrim requires be paid for services they code as “deductible eligible” before Harvard Pilgrim pays.

- Len-Tex’s HRA (applied to POS and Copay plans only) pays the first $1500 in deductible expenses if you have single coverage, or the first $2000 if you have dependents on your plan

- Coinsurance: Once you have reached the Harvard Pilgrim deductible amount, if you need additional services that are coded as “deductible”, when there is coinsurance, you’ll need to pay that percent, until you reach the Out-of-Pocket (OOP) Maximum amount. Coinsurance is NOT eligible for HRA funds.

- Copay: These are flat dollar amounts applied to some office visit, medical services and prescription drugs. Copays are NOT eligible for HRA funds.

- Out-of-Pocket (OOP) Max: This is the “worse-case-scenario”, the most you will have to pay when you receive services or Rx that Harvard Pilgrim determines to be “covered medical expenses”. Len-Tex’s HRA can reduce the OOP Max amount if you are enrolled in the POS or Copay plan and incur deductible-eligible expenses.

All three plans cover preventive services in full, such as annual checkups, immunizations, and other services based on your age and gender, according to Preventive Services Task Force. (Not based on your personal or family history, and/or your physician’s recommendation.)

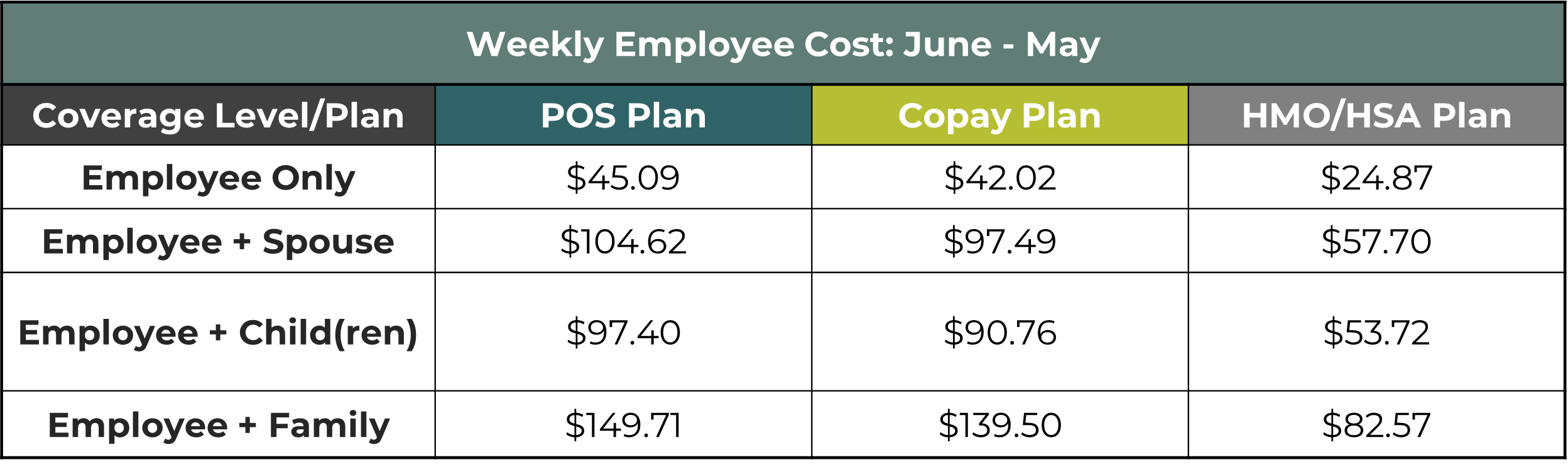

Contributions & Rates

The chart below shows the weekly payroll deduction for various coverage levels of the plan.

Carrier Contact Information

Summary of Benefits & Coverage (SBC)

Schedule of Benefits (SOB)

RX Formulary

Benefit Handbook

My HRA

Health Reimbursement Account (HRA)

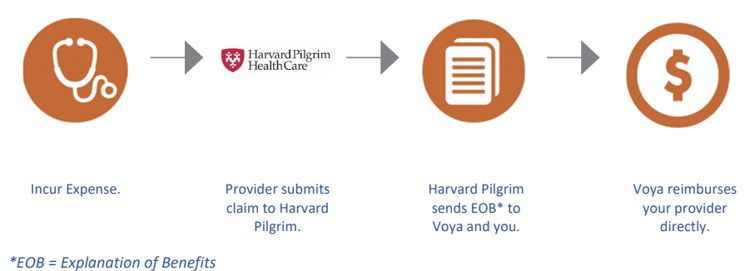

What is a Health Reimbursement Account? Health Reimbursement Accounts (HRAs) are dollars your employer provides to help pay a portion of your deductible expenses. If you do not use these dollars they remain with the employer. Voya manages our HRA funds.

Who is eligible?

If you are enrolled in Len-Tex’s POS or Copay plan, you are automatically enrolled in the HRA. If you are enrolled in the HMO/HSA plan, you will not be eligible for the HRA.

How it Works

Reimbursement: Len-Tex’s HRA pays the first $1,500 of deductible expenses if you have single coverage. If you have dependents on your plan, the HRA will pay the first $2,000 in deductible expenses. Voya pays your provider directly. A debit card for prescription purchases is available (except for copay plan members).

Your Responsibility: You pay any remaining deductible amounts, and coinsurance and copays as applicable.

Not a Savings Account: HRA funds reset annually and don’t roll over. Unused funds return to the employer

Carrier Contact Information

Phone Number: 833-232-4673

Create an Account:

Log on to Myhealthaccountsolutions.voya.com or download the Mobile App to:

- Track your deductible.

- View HRA payments to your providers.

Summary of Benefits & Coverages (SBC)

My HSA

Health Savings Account (HSA)

Len-Tex’s HMO/HSA plan is “HSA-eligible” which means employees who are enrolled in it and do NOT have medical coverage elsewhere – including through Medicare, the Veterans Administration (VA), their spouse’s or parent’s plan, or through a full purpose FSA – are able to establish and make contributions to a personal Health Savings Account, or HSA. For convenience, Len-Tex has established a relationship with the Savings Bank of Walpole to establish and maintain HSA accounts.

An HSA is a triple-tax-advantaged trust/custodial account that eligible individuals can use to pay for qualified medical, dental and vision expenses for themselves or their tax dependents.

Triple-tax-advantaged: Contributions are pretax, interest accumulates tax-free, distributions for qualified expenses are tax-free.

Contributions may be made through payroll deduction or directly to the Savings Bank of Walpole from your personal checking or savings account.

Contribution limits in 2025: $4,300 for single coverage and $8,550 for dual/family coverage. If age 55+, additional $1,000.

You may pay for eligible expenses with the debit card issued by the Savings Bank of Walpole or using another form of payment and requesting reimbursement from your HSA.

Funds in your HSA account will accumulate and grow until you remove them. If your employment ends at Len-Tex, your account may remain with the Savings Bank of Walpole. If you enroll in another HSA-eligible health insurance plan and remain eligible to make contributions, you may resume contributions. If you are not enrolled in an HSA-eligible health insurance plan, you may use the funds to pay for qualifying medical expenses but cannot make future contributions.

While your HSA account belongs to you, and you may use the funds for any purpose, withdrawals/distributions for purposes other than qualifying medical expenses will be taxed as ordinary income and subject to a 20% penalty tax before age 65. After age 65, 20% penalty not assessed, but distributions for expenses other than qualified medical will be taxed

Carrier Contact Information

Flexible Spending Accounts

Flexible Spending Accounts (FSA)

Len-Tex offers three different types of Flexible Spending Accounts. Employees may contribute pre-tax dollars into these accounts to help offset eligible health expenses or dependent care expenses. These plans are administered by Voya.

General Purpose Flexible Spending Account (FSA)

Funds from a general-purpose FSA can be used for qualified expenses including deductibles, co-payments, and coinsurance. With an FSA, the entire elected amount is available on the first day of the health plan year. You may contribute to a Health FSA if you are enrolled in either the POS plan or the Copay Plan ONLY. You are not eligible for this option if you contribute to an HSA. The annual FSA contribution limits are as follows:

- Maximum contribution: $3,300

- Rollover amount: $660

- Available with POS Plan and Copay Plan

Limited Purpose Flexible Spending Account (LPFSA)

Funds from a Limited Purpose FSA can be used for qualified dental and vision expenses ONLY. With an LPFSA, the entire elected amount is available on the first day of the health plan year. You may contribute to a LPFSA if you are enrolled in HMO-HSA plan. The annual LPFSA contribution limits are as follows:

- Maximum contribution: $3,300

- Rollover amount: $660

- Available with the HMO/HSA Plan if you elect establish and contribute to an HSA

- This account will cover your out-of-pocket expenses for dental and vision ONLY

Dependent Care Flexible Spending Account (DCA)

A dependent care FSA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care.

- Maximum contribution: $5,000 (if single or married & filing jointly) or $2,500 (if married & filing separately)

- No rollover amount

Carrier Contact Information

Phone: 833-232-4673

For a full list of qualified expenses allowed by the IRS, see Publication 502 (www.irs.gov/publications/p502)

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Dental Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible the first of the month following 60 days.

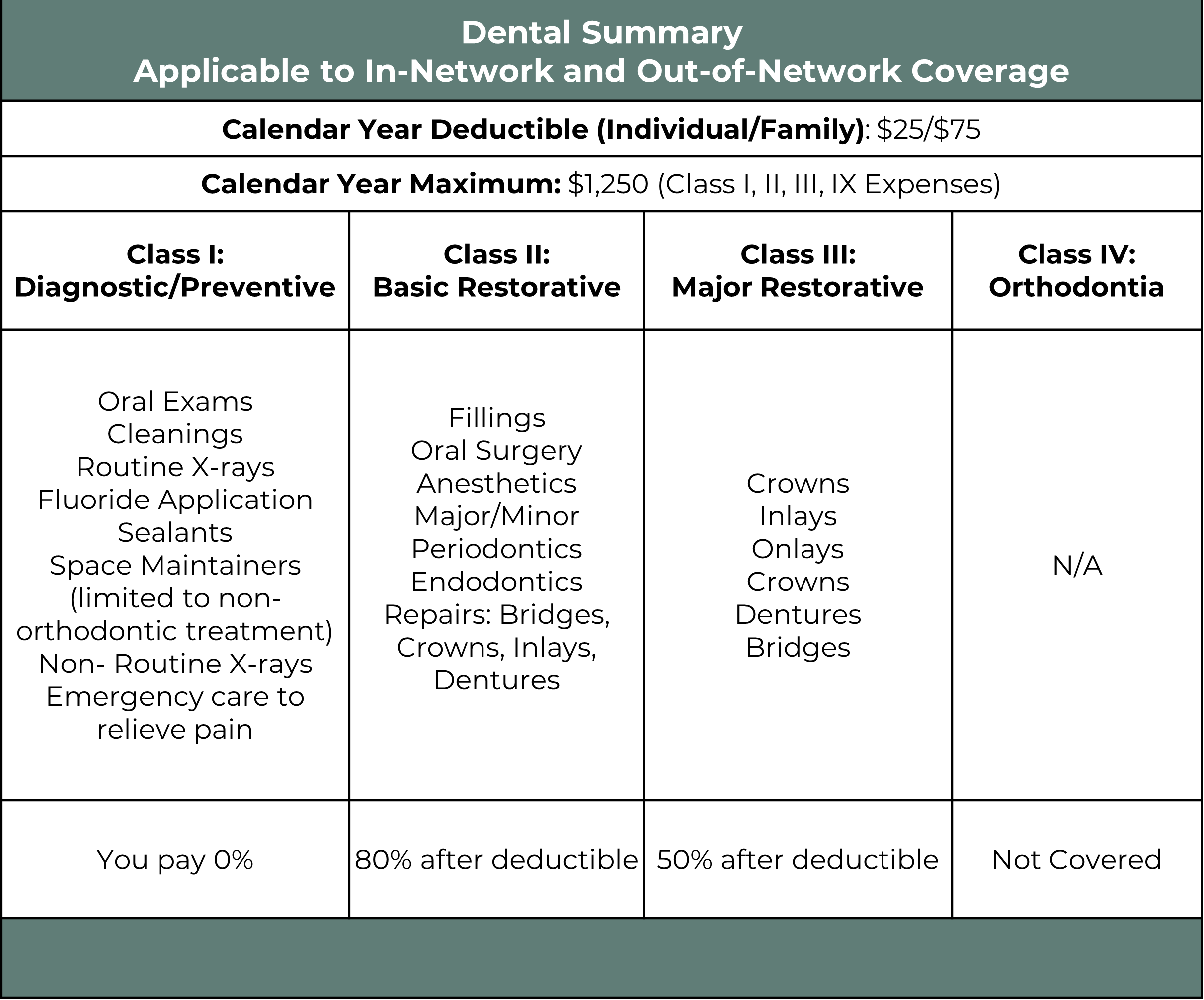

Plan Overview

In addition to protecting your smile, dental insurance helps pay for dental care and usually includes regular checkups, cleanings and X-rays. Several studies suggest that oral diseases, such as periodontitis (gum disease), can affect other areas of your body—including your heart. Receiving regular dental care can protect you and your family from the high cost of dental disease and surgery.

The chart below outlines the dental benefits offered by Len-Tex.

Carrier Contact Information

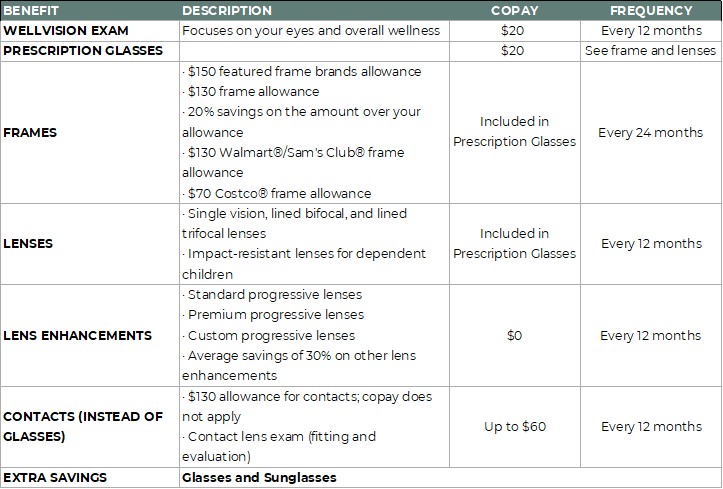

Vision Benefits

Eligiblity

All full-time regular employees who work a minimum of 30 hours per week are eligible the first of the month following 60 days.

Plan Overview

Len-Tex Corp’s vision insurance covers routine eye exams, procedures, and offers set discounts or allowances for glasses, sunglasses, and contacts. To find in-network providers at www.vsp.com under the Access Network.

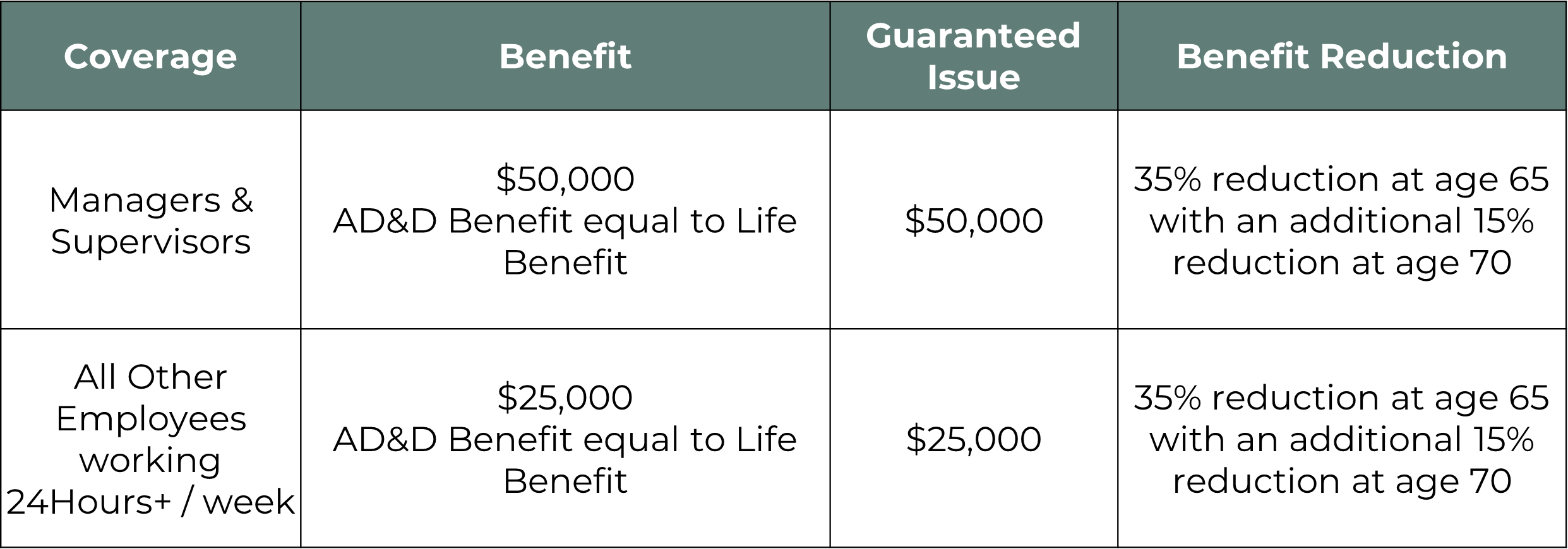

Group Life and AD&D

Summary of Group Basic Life and AD&D Benefits and Coverages

Group Life and Accidental Death & Dismemberment (AD&D) insurance provides financial protection for your loved ones in the event of your death or a serious accident. This coverage offers peace of mind by helping to ease the financial burden during a difficult time. Len-Tex provides employer-paid Group Life and AD&D insurance to eligible employees.

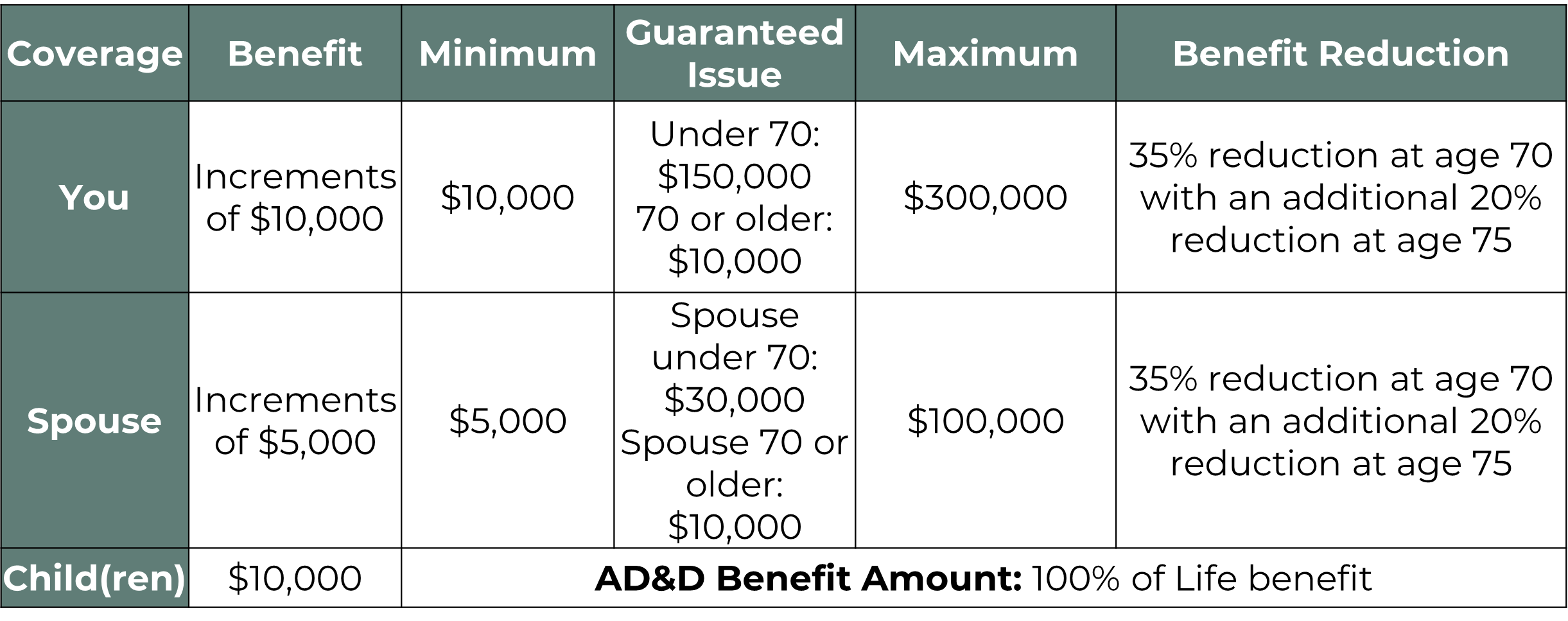

Voluntary Life and AD&D

Summary of Group Basic Life and AD&D Benefits and Coverages

Len-Tex also offers Voluntary Life and AD&D insurance to eligible employees. This optional benefit provides added financial protection in the event of death or a covered accident, giving you flexibility to meet your family’s needs.

Employees purchasing Voluntary Life/AD&D for their spouse may only elect coverage amounts up to 100% of the employee’s self-election.

Employees and spouses are subject to proof of health/evidence of insurability (EOI) for coverage exceeding $150,000 for the employee and $30,000 for the spouse

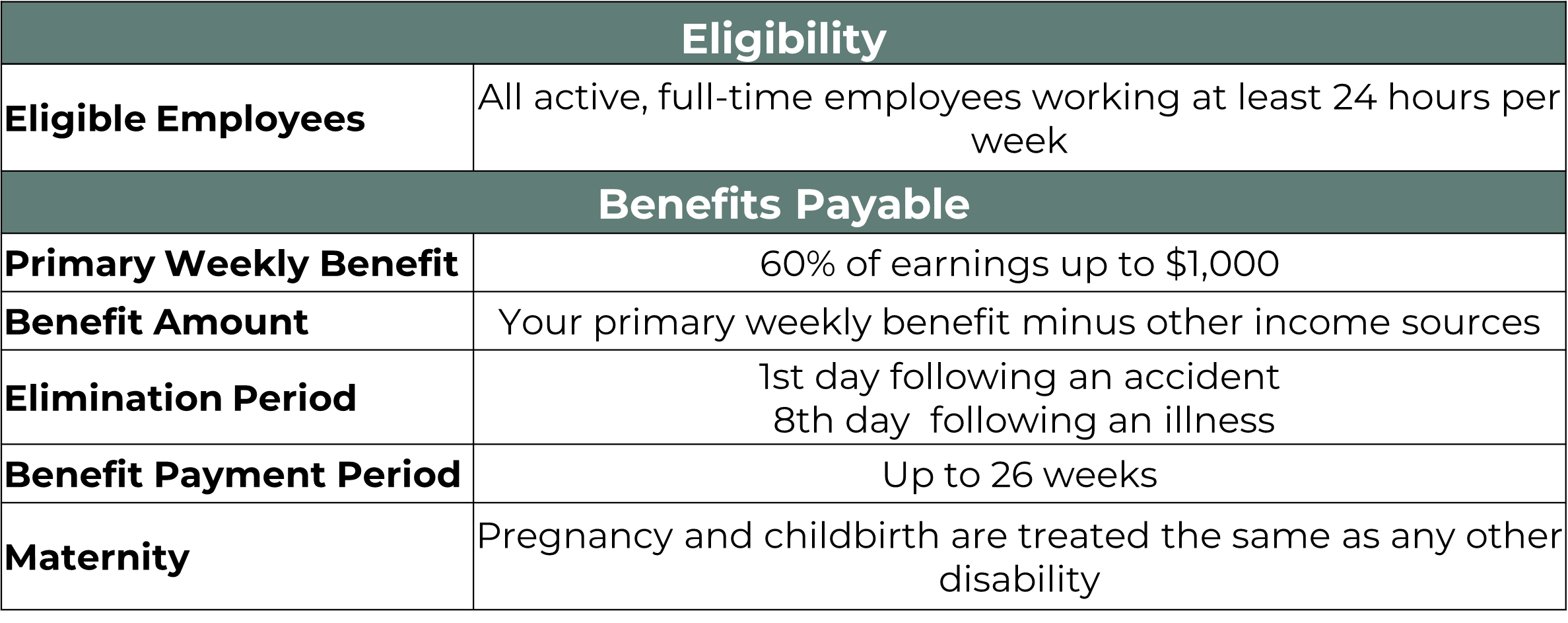

Short & Long Term Disability Insurance

Short Term Disability

Short-Term Disability (STD) provides partial income replacement if you’re unable to work due to a non-work-related illness, injury, or medical condition, helping reduce financial stress during recovery. Len-Tex pays for this benefit for all eligible employees. Below is a summary of the STD benefit.

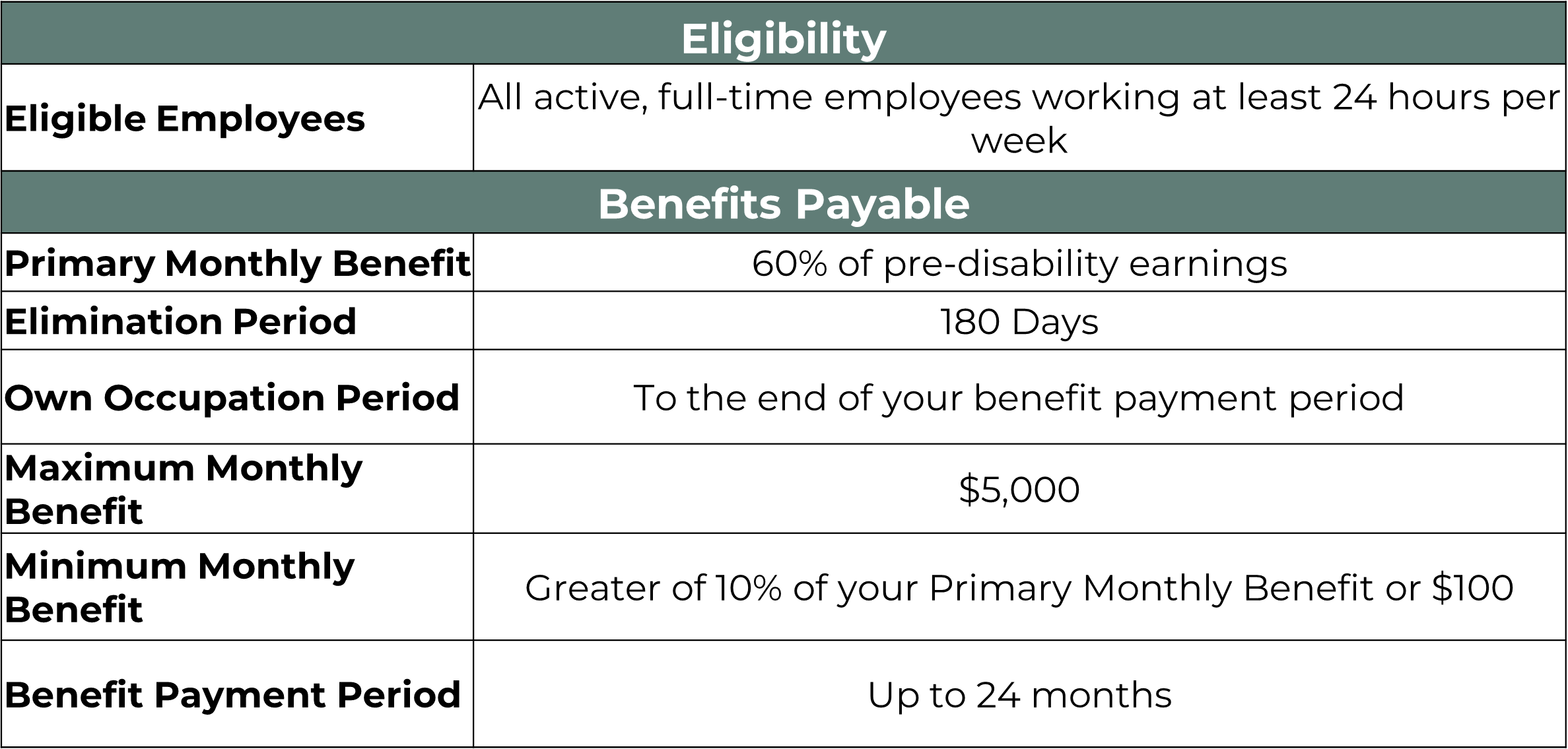

Voluntary Long Term Disability

Long-Term Disability (LTD) offers income support if you’re unable to work long-term due to a serious illness or injury, helping maintain financial stability. Len-Tex offers employees the opportunity to purchase voluntary long-term disability coverage. The benefit is not part of the annual open enrollment. If you did not elect coverage when first eligible, you must complete a health questionnaire and will be subject to medical underwriting approval.

Carrier Contact Information

Forms & Plan Documents

Short & Long Term Disability Insurance

Summary of Benefit

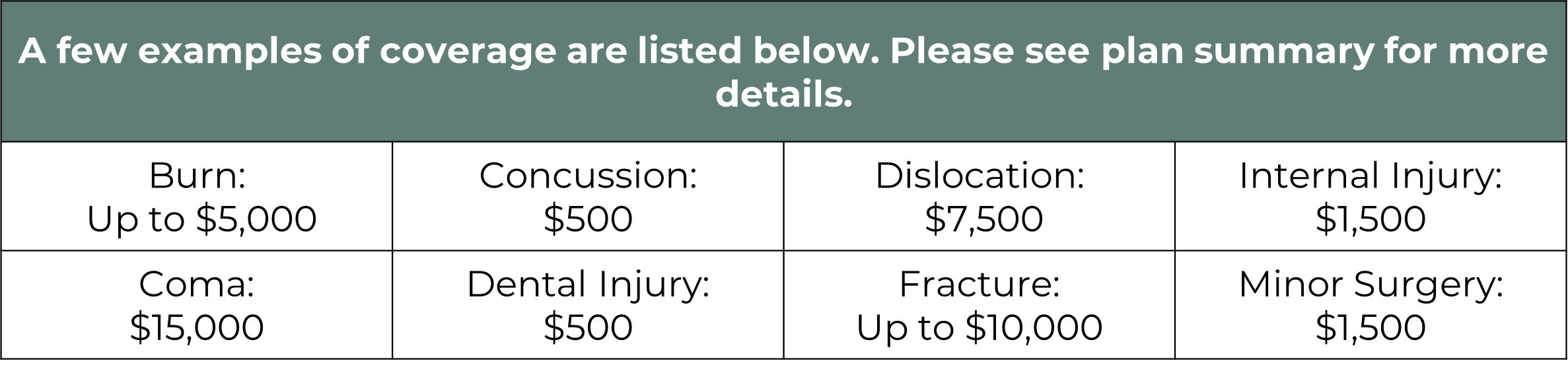

Group Accident Insurance provides financial protection by paying benefits for covered injuries resulting from accidents. It helps cover out-of-pocket costs like medical bills, emergency care, or hospital stays, offering added peace of mind for unexpected events.

Principal’s Accident coverage provides a lump sum payment based on the type of injury (or covered accident) you sustain or the type of treatment you receive.

Choose the coverage that is right for you. Accident insurance is offered to all eligible employees who are actively at work. You can also purchase coverage for your spouse, domestic partner and dependent children.

Carrier Contact Information

Forms & Plan Documents

Employee Assistance Program

Summary of Benefits and Coverages

Life can be unpredictable, but support is available when you need it. Eligible employees enrolled in Len-Tex’s Life & Disability coverage have access to Principal’s free, confidential Employee Assistance Program (EAP) through Magellan Healthcare for help with everyday and complex life challenges.

In-person or Virtual Counseling

One valuable way to work through personal or work issues is by talking with a professional. You and your family can meet with a licensed EAP professional in person, via text message, or by live chat, video, or phone sessions. Three counseling sessions per year are included.

Legal Services

Receive a free 60-minute consultation to help deal with issues such as car accidents or family law.

Financial Wellness

Receive three free 30-minute consultations. This may include help with budget planning, debt consolidation, or retirement planning.

Identity Theft Services

Receive a free 60-minute consultation to help restore your identity if stolen.

Work-life Web Services

You and your family can access webinars, live talks, and articles on topics such as child and elder care, education, parenting, and more.

Carrier Contact Information

24/7 Employee Assistance and Wellness Support

Phone: (800) 450-1327 TTY: 711

When you create a free account, enter Principal Core as the program name.

Additional Information

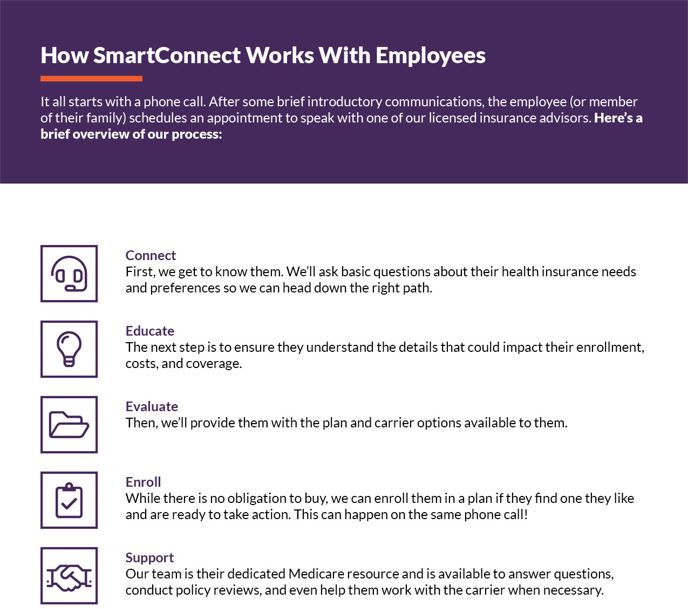

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartconnectplan.com/wideplankflooring

Phone: 833-998-4562TTY: 711

Additional Information

Wellness

Wellness Bonus

All full-time and part-time Carlisle employees can earn up to a $100 bonus* for completing qualifying wellness activities. View the Wellness Bonus form for more information.

*Due to IRS regulations, the Wellness Bonus is subject to payroll taxes.

Wellness Purchase Reimbursement & Gym Bonus

In addition to the Wellness Bonus, all full-time benefit eligible Carlisle employees can earn:

- Up to a $100 reimbursement for qualifying wellness purchases each year

- Up to a $400 gym bonus each year

See the Wellness Reimbursement and Gym Bonus forms for more details.

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/